Browsing Conformity with Comprehensive Singapore Payroll Services

Browsing Conformity with Comprehensive Singapore Payroll Services

Blog Article

Enhancing Financial Conformity and Coverage Via Advanced Pay-roll Services

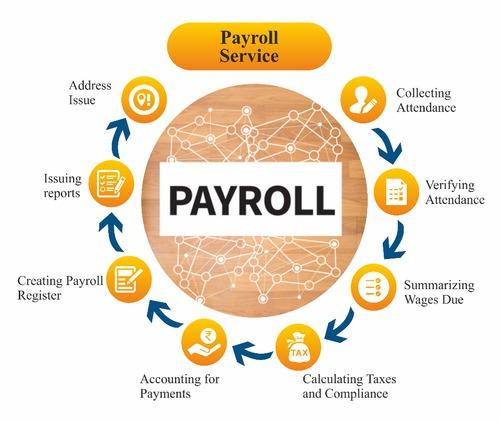

In today's dynamic organization landscape, the realm of financial conformity and reporting stands as a foundation of organizational security and development. Advanced pay-roll services have actually become a crucial device in making sure adherence to regulatory needs and cultivating transparency in monetary procedures. By leveraging advanced technologies and innovative solutions, companies can improve their payroll processes, boost precision, and minimize compliance risks. The true potential lies not just in these enhancements but additionally in the transformative influence they can have on the more comprehensive economic community. As we discover the detailed interplay in between innovative pay-roll services, monetary conformity, and coverage, a deeper understanding of the opportunities and obstacles that lie ahead unfolds.

Benefits of Advanced Pay-roll Solutions

Executing advanced pay-roll remedies can dramatically boost effectiveness and accuracy in monetary processes within a company. One of the essential advantages of sophisticated payroll solutions is automation.

One more advantage of advanced pay-roll services is boosted compliance. With regularly transforming tax legislations and guidelines, it can be testing for organizations to stay certified. Advanced pay-roll systems frequently come equipped with built-in conformity functions that aid make sure payroll procedures stick to existing regulations and guidelines. This lowers the threat of pricey fines and charges for non-compliance.

Additionally, progressed pay-roll services offer enhanced reporting abilities. These systems can generate thorough records on different elements of pay-roll, such as labor prices, tax obligations, and fringe benefit. These records supply beneficial insights that can assist organizations make notified choices and better handle their financial resources. Generally, the benefits of sophisticated pay-roll solutions make them a valuable investment for companies wanting to optimize their monetary procedures.

Automation for Improved Precision

Advanced pay-roll solutions not just simplify jobs such as computing wages and tax obligations but also leverage automation to enhance precision in monetary procedures, specifically through the implementation of automated systems for boosted precision - Singapore Payroll Services. Automation plays an important duty in guaranteeing that payroll information is processed properly and successfully. By automating processes such as time tracking, payroll calculations, and tax reductions, the possibility of human mistakes is substantially decreased

Additionally, automation enables real-time information assimilation, enabling for prompt updates and precise reporting. This not just conserves time but likewise improves decision-making processes by offering updated and trusted monetary information. On the whole, the integration of automation in payroll services causes enhanced precision, efficiency, and compliance in financial coverage.

Compliance Attributes in Payroll Software Application

Additionally, many payroll software application services use automated notifies and alerts to remind users of vital conformity due dates, such as tax obligation declaring days or qualification renewals. This proactive strategy assists companies remain on top of their compliance requirements and stay clear of expensive blunders. On the whole, the conformity features in pay-roll software application function as a beneficial tool for enhancing this hyperlink monetary compliance and reporting accuracy within companies.

Reporting Enhancements With Advanced Equipment

Enhancing financial information analysis and presentation, contemporary payroll software includes sophisticated reporting devices that use extensive insights into business performance. These advanced reporting enhancements make it possible for businesses to generate thorough reports on different elements of pay-roll management, such as staff member prices, tax deductions, benefits distribution, and labor expenditures. By leveraging interactive visualizations and customizable control panels, stakeholders can quickly analyze intricate pay-roll data, recognize trends, and make notified choices.

Furthermore, with real-time coverage capacities, organizations can access updated details immediately, permitting nimble decision-making and aggressive economic planning. Advanced devices likewise help with conformity with governing demands by automating record generation and making certain accuracy in monetary declarations. Additionally, these reporting functions can be customized to particular user roles, providing appropriate information to executives, managers, and HR workers as needed.

Future Fads in Pay-roll Innovation

As the landscape of payroll innovation proceeds to develop swiftly, emerging patterns are improving the method companies manage their financial processes. One significant fad is the raising integration of expert system (AI) and artificial intelligence in payroll systems. AI can streamline payroll processes by automating recurring jobs, boosting data precision, and offering useful understandings for decision-making. Another crucial fad is the surge of cloud-based pay-roll remedies, using scalability, adaptability, and boosted security for sensitive monetary data. Mobile pay-roll applications are also coming to be much more common, allowing workers to access their pay information conveniently and allowing smooth interaction between staff and payroll divisions. Moreover, the emphasis on data analytics in pay-roll technology is expanding, with predictive analytics enabling organizations to anticipate labor costs, recognize patterns, and optimize source allocation. These future trends in payroll innovation are poised to change how companies handle their payroll operations, driving performance, conformity, and calculated decision-making.

Conclusion

In final thought, advanced payroll services use many benefits such as enhanced precision via automation, improved conformity features, and reporting enhancements. The future fads in payroll modern technology suggest additional developments in streamlining financial conformity and reporting procedures. Singapore Payroll Services. Organizations that carry out these advanced pay-roll solutions can anticipate to see raised performance, reduced errors, and better total financial administration

Advanced payroll systems frequently come geared up with built-in conformity attributes that help guarantee pay-roll procedures adhere to current regulations and policies.Guaranteeing adherence to governing needs and sector requirements, payroll software program is furnished with durable conformity attributes that help with accurate economic reporting and governing conformity. Generally, the compliance features in payroll software application serve as a valuable tool for boosting economic conformity and reporting accuracy within organizations.

Mobile pay-roll applications are also becoming much more common, permitting staff members to access their pay details conveniently and making it possible for smooth communication in between team and payroll divisions. These future patterns in pay-roll technology are poised to reinvent how companies handle their payroll procedures, driving efficiency, conformity, and critical decision-making.

Report this page